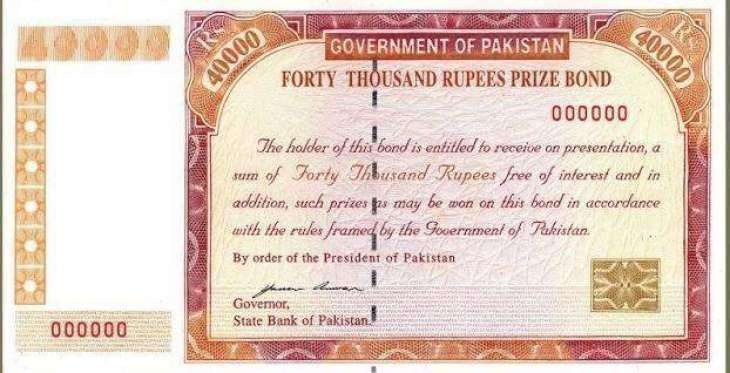

Rs 40,000 Prize Bonds: Govt announces deadline for registration

Islamabad: The government on Thursday offered relaxation to the bearers of Rs40,000 denomination prize bonds, allowing the investors to register their unregistered bonds up to March 31, 2020.

Following the decision of Economic Coordination Committee’s (ECC) of the cabinet, the holder of Rs40,000 denomination prize bond could take benefit of various facilities in registering their bonds, according to press statement issued by the Finance Ministry.

Rs 40,000 Bearer Prize Bonds could be converted to Premium Prize Bonds (Registered) through 16 field offices of SBP Banking Services Corporation, and authorized branches of six commercial banks i.e.National Bank of Pakistan, United Bank Limited , MCB Bank Limited, Allied Bank Limited, Habib Bank Limited and Bank Alfalah Limited.In addition, the statement said.

Rs.40,000 Bearer Prize Bonds holder can avail the opportunity to replace the bonds with Defence Saving Certificates (DSC) or Special Saving Certificates (SSC) through the 16 field offices of SBP Banking Services Corporation, authorized commercial banks and National Savings Centres.

Rate of return on DSC and SSC are very attractive, the statement said adding that currently, annual rate of return on DSC is 12.47% whereas annual (average) rate of return on SSC is 11.57%.

Furthermore, in case the bond holder desires to encash the bond, the encashment proceeds would be credited to the specified bank account of the holder.

In this context, SBP and other banks would extend their maximum support to make sure the transfer of payments to respective account of the holder.

It reiterated that the Rs. 40,000 Prize Bonds (Bearer) need to be registered up to 31st March, 2020 and any of the aforementioned opportunities can be availed for the purpose.

It is clarified that the investment of the bond holder is safe in any case.

ECC had further decided that no further prize bond draw of Rs 40,000 would be held, however, all the prize money claims on the already held draws could be claimable within the period of six years from the date of respective draw, as per National Prize Bonds Rules, 1999.

Finance Division further informed that Rs 40,000 Premium Prize Bond (Registered) has already been launched w.e.f. March 10, 2017.

Registered Prize Bonds offer not only attractive prizes through quarterly draws but also pay reasonable profit through biannual coupon payments.

All the payments are made to investor’s bank account through an automated system.

Further, Prizes on Rs 40,000 Premium Prize Bonds (Registered) are more attractive compared to bearer bonds.

The registered bonds are secure and not prone to forgery and theft.

Finance Division has already discontinued the fresh issuance of Rs.40,000 bearer bonds w.e.f.February 14, 2019.

It is further clarified that issuance, encashment and Prize Bond draws etc.in respect of all other denominations of bearer prize bonds would continue as per exiting procedure, according to National Prize Bonds Rules.